Benefits of alternative investments in a diversified portfolio

In our last article we looked at what is an alternative investment. To recap, alternative investments refer to financial assets that sit separate to the three traditional forms of investments: stocks, bonds, and cash. In this article we’ll focus on the benefits of alternative investments.

To assist in building long term wealth, it is advisable to build a diversified portfolio. A diversified portfolio means investing in varying asset types and classes, such as stocks, bonds, cash, real estate etc. This provides an investor the ability to reduce losses due to market fluctuations, reduce overall portfolio volatility (lessen the impact of big fluctuations) and improve their overall return over the medium to long term.

Alternative investments such as private credit, real estate and private equity can play a useful role in creating portfolio diversification for a number of reasons. Whilst institutional investors have been accessing and investing in alternative investments for decades, there are now ways individual investors can also access these types of investments.

Benefits of alternative investments for individual investors

Portfolio diversification

Like in life, when investing it is wise not to put all your eggs into one basket and to invest into more than one asset type. Most savvy investors want to safeguard their asset pool, and do not want to expose too much capital to the same risks. If one market (security, asset, bond, investment strategy etc) falls, having investments in other markets with different drivers can offset those losses and provide a more reliable stream of return. This is one of the benefits of alternative investments and how they can work in an investment portfolio.

Alternative investments typically have a low correlation to how public markets (e.g., the stock market) perform. This means that their performance does not change relative to the ups and downs of the market, adding greater stability to a portfolio and reducing overall portfolio risk without sacrificing financial return.

Alternative assets can be categorised as either ‘return enhancers’ or ‘return diversifiers.’ A return enhancer refers to an asset added to a portfolio with the expectation of a higher average return. A return diversifier refers to an asset added to a portfolio because of its low correlation to other assets, with the aim of reducing risk across the overall portfolio.

Alternative investments can reduce overall portfolio volatility

A portfolio with high volatility is subject to more fluctuations. The resulting potential to change rapidly and unpredictably can severely impact the effect of compounding. This will likely have a negative effect on the overall performance and return your portfolio generates over time.

Most alternative investments are not publicly traded. They are also tied to a tangible asset making them less volatile than traditional assets such as shares. This allows an investor to potentially achieve a more stable return year to year, aiding the effect of compounding and producing a larger financial return and portfolio growth over the long term.

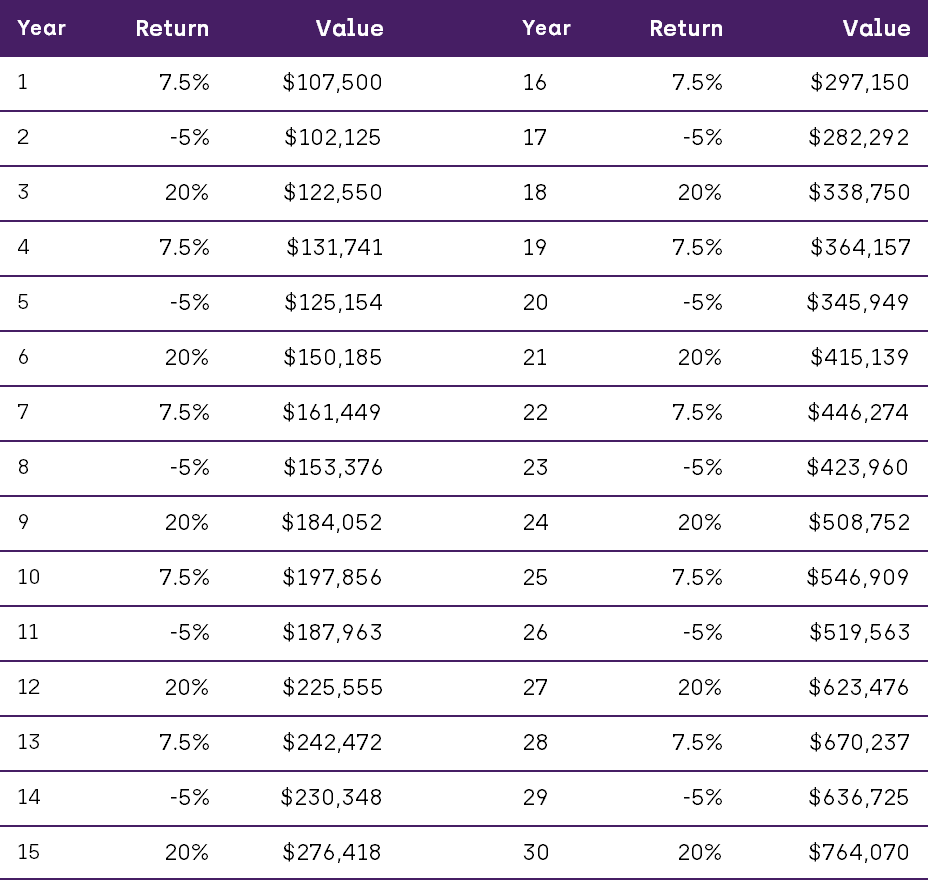

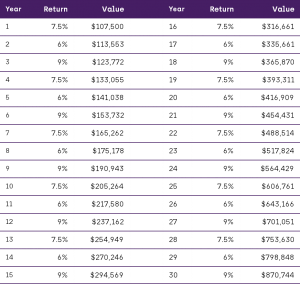

The below example demonstrates the effects of portfolio volatility and why it is in an investors best interests to limit. In both scenarios an investor initially invests $100,000 into a portfolio with a 30 year time frame. The only difference being the level of portfolio volatility. While these scenarios aren’t indicative of real world market fluctuations, they help to understand how portfolio volatility affects long term portfolio return.

Scenario 1

The initial $100,000 is invested in a portfolio that returns a respectable 7.5% per year on average. In this scenario the portfolio is subject to a higher level of volatility meaning it suffers bigger gains and losses. After 30 years the portfolio has grown in size to $764,070.

Scenario 2

The initial $100,000 is invested in a portfolio that also returns a respectable 7.5% per year on average. In this scenario the portfolio is subject to a lower level of volatility. The result being a more stable return year in, year out. After 30 years the portfolio has grown in size to $870,744 giving the investor an additional $106,674.

Enhanced portfolio returns and regular passive income

Some alternative investments, as a standalone, carry a higher level of risk. This gives an investor the potential to gain a much higher return over the medium to long term compared to traditional assets. Many, but not all, alternative investments also offer the choice of monthly or quarterly cash returns. This provides investors with regular income or the option to reinvest and generate further returns.

New opportunities

Alternative assets allow investors to gain access and new levels of exposure outside the scope of traditional investments. Whilst the most common alternative investments include private equity, real estate projects and infrastructure, fine art, wine and NFT’s to name a few are other types of alternative investments an individual investor could consider.

Lower transaction costs

While alternative investments often have higher upfront costs when compared to traditional investments, they often have lower on-going fees and are held for longer periods of time. This in turn reduces the number of transaction costs often associated with shorter term investments, such as shares.

Accessing alternative investment opportunities

For those looking to access alternative investments there are two main approaches; direct investment into assets and ‘look through’ ownership into a fund style investment, typically through a fund manager. Both direct and look through ownership have their advantages and disadvantages. A well-constructed and diverse investment portfolio will include both types of asset ownership.

At Remara we offer wholesale investors the opportunity to access alternative assets through three distinct fund style investment products.

Private Credit Fund

Our private credit fund offers investors secure long-term income through monthly payments or a reinvestment plan. It current has a rolling annual return of 13.30$ (post fees). To find out more click here or for an overview of private credit click here.

Tactical Opportunities Fund (private equity, hedge fund, venture capital)

Designed for investors looking for a long-term investment opportunity. Our fund gives portfolio diversification and exposure on a global scale across equity, fixed income, currency and commodity markets.

Real Estate Fund

Our real estate fund provides investors access to a highly diversified pool of development opportunities across smaller projects. It is designed to limit risk and concentration exposure, while providing investors attractive risk adjusted returns. Interested to know more? Click here.

Now that you know the benefits of alternative investments, in our next article we’ll focus on the potential risks of investing in alternative assets. We’ll also look at why it is important that investors who are looking to access alternative investments through a ‘look through approach,’ do so with a fund manager that is open and transparent and one that structures their investment products to mitigate risk and generate above average returns.