Strategies for investing in commercial real estate

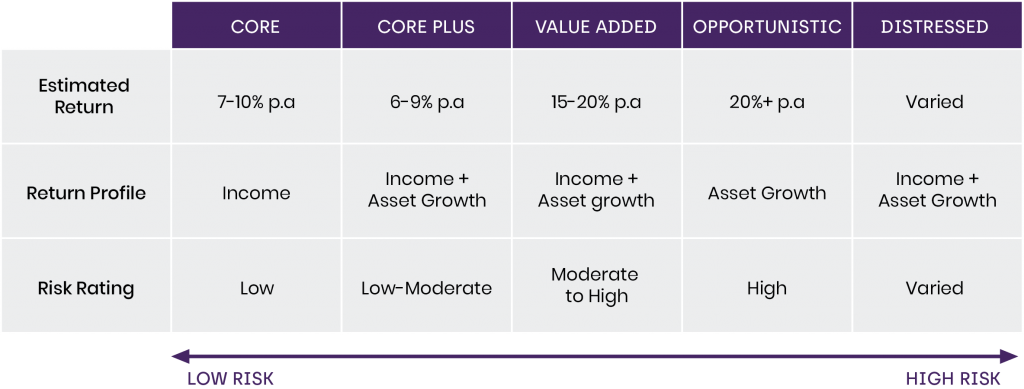

Commercial real estate investing strategies can be broken down into five main categories: core, core plus, value-add, opportunistic and distressed. The categories are used to define the risk and return profile of each specific commercial real estate investment. The risk and return of the investment is based on the quality, location and potential of the property/s in question, together with the amount of debt used to fund the investment, the length and term of any leases in place and the credit worthiness of the tenants.

Core commercial real estate investments

Core commercial investments are considered ‘Class A’ properties and make up the foundation of a commercial real estate investment portfolio. ‘Class A’ refers to properties that are in buildings and locations of superior quality. They are fully leased properties occupied by high quality tenants. Typically, they are found in diversified metropolitan areas and are purchased with less than 30% debt, offering investors a low risk profile. Generally, a core investment is held for a long period of time and produces a predictable income stream with little variability. Most of the expected return is realised through cash flow from the property, as opposed to an increase in the property’s underlying value.

Risk: Low

Return: 7 – 10% p.a

Amount of debt: 0 – 30%

Core-plus commercial real estate investments

Although sharing some similarities with core investments, core-plus properties tend to be in good, but not great locations and often require renovation, repositioning or releasing. For these reasons they are referred to as ‘Class B’ properties. Core-plus real estate investments have a moderate risk/return profile, and usually require a higher-level debt to purchase. Whilst returns can be higher, cash flow can be less predictable. Core-plus returns are generated both from cash flow and an increase in the value of the property once renovations or changes have been made, or reletting has occurred.

Risk: Low – Moderate

Return: 6 – 9% p.a

Amount of debt: 30 – 55%

Example: A stable multi-family building located in metropolitan Sydney, that is under-managed.

Value added commercial real estate investments

Value added investments involve purchasing a commercial property that is either currently under performing with low tenancy levels or needs major renovations or repositioning. In most instances the end goal is to resell the property at an opportune time for a substantial gain. With a medium to high risk profile, value add investments tend to have very little cash flow at the time of purchase but have the potential to produce a significant amount of cash flow once the value has been added.

Typically purchased with a high level of debt and held for 3-10 years, they are best suited toward investors who have a strong knowledge of real estate, are available to have daily oversight and are strategically minded. Expected returns of 15 – 20% p.a are generated both from cash flow once the renovations or reletting has occurred, and an increase in the value of the property.

Risk: Moderate to High

Return: 15 – 20% p.a

Amount of debt: 50 – 70%

Example: a 1970’s office building in need of renovation. Post-renovation, it would be repositioned as a ‘Class A property’, with new tenants, higher leases, and asset value.

Opportunistic commercial real estate investments

Considered the riskiest of the five types of commercial real estate investment strategies, opportunistic investments also carry the potential for the highest returns. Often referred to as ‘ground up investments’ it includes properties that require significant re-development, construction of new developments or investments into raw land or niche property sectors.

It is not uncommon for these types of investments to not see any returns for the first 3 or more years and often have zero cash flow at the time of purchase. They are generally purchased with a high level of debt and can offer returns of around 20% p.a. It is not considered wise to undertake an opportunistic investment strategy unless you are a highly skilled investor with years of experience.

Risk: High

Return: 20% plus p.a

Amount of debt: 65% plus

Example: purchase of land and construction of new office building or coworking space.

Distressed commercial real estate investments

A distressed commercial real estate investment involves investing into what is referred to as a distressed building or property; a property priced at a significant discount due to problems with the actual structure of the building, building management or tenants. Dependant on the issues and circumstances associated with the distressed investment, the associated risk/return profile tends to vary more widely.

Example: investing in a real estate asset at a significant discount due its original owner declaring bankruptcy.

Risk: Varied

Return: Income + Asset growth

Amount of debt: 65% plus

Are you looking to invest in commercial real estate?

The five categories as discussed above assist individuals or institutions determine risk and return expectations. They also allow an investor to actively seek out and invest in a commercial real estate investment strategy where the risk tolerance, time horizon and investment objectives matches their own requirements.

As an example, core commercial investments tend to be looked at more favourably by older investors or investors who look more for income stability and preservation of capital. On the flip side value-added investments are suited towards those that look for both cash flow and value growth. It is important when investing into commercial real estate to look at these designations and strategies and to choose appropriately.

Traditionally real estate has been accessible only to those with larger financial means due to its capital-intensive nature. However, with more modern fund structures, ownership can be broken down into more digestible portions that require lower financial commitments. Our real estate opportunistic development fund provides investors the opportunity to invest into a diverse range of investment opportunities spanning across both residential and commercial real estate that might otherwise be inaccessible. To find out more contact Remara today.